Quote Today Blog |

|

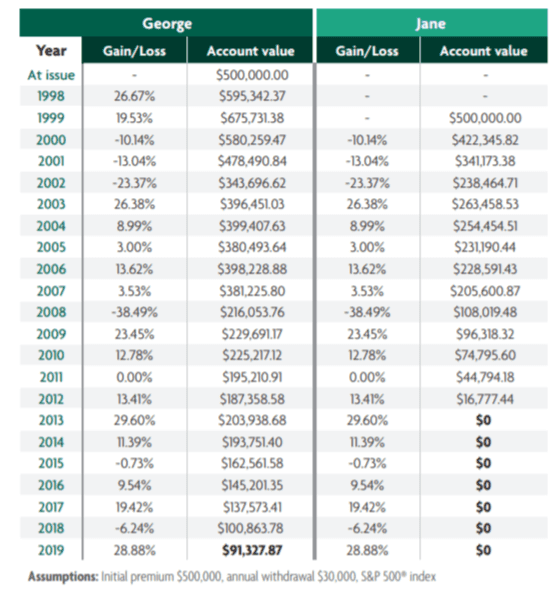

Reading Time: 5 minutes People typically think of the average rate of returns when it comes to sustaining their retirement income. However, what might be more impactful is not the average return, but the order of returns. Take, for example, the case of George and Jane. Both have $500,000 saved for retirement. George retires and begins taking withdrawals in 1998. Jane then retires in 2000 and begins to take the same amount in withdrawals as George. You would expect that both would have an equal depletion of their assets and run out of money two years apart, but because of sequence of returns, this is not the case. 21 years later, with just a difference of two years from when withdrawals started, George still has over $100,000 while Jane’s account is depleted by year 15. To help mitigate the risk of potentially outliving retirement savings, a fixed index annuity (FIA) might be an option. FIAs can offer a balance of both protection from market downturns and growth potential. A balancing actWith so many potential hurdles and uncertainty, some may want to find a retirement income planning product that helps balance the need for stability and provides growth potential. FIAs can offer both. A fixed index annuity has the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns. Some key features of FIAs are: Annual resetAn annual reset feature locks in interest credits annually, meaning gains cannot be lost due to market decreases. The “annual” reset feature applies to credit terms that span one year. For terms longer than a year, the reset feature coincides with the length of the term. This feature helps both in growing and in protecting your retirement nest eggs; not only will they not lose accumulation value from market downturns, but the new starting point for future growth calculations is the lower index value. Financial stabilityFixed index annuities are designed to provide reliable lifetime income. Comparing FIAs to other popular retirement planning options, we see that it is on the lower end of the risk spectrum. Premiums cannot be lost due to a market downturn. Adding a fixed index annuity can serve to complement many retirement portfolios, including those on the higher side of the risk spectrum because they offer protection from market downturns and growth potential.

Fixed index annuities are an attractive option for many looking to add stability to their retirement income plans. Not only can a FIA offer growth potential, it can also provide protection from market downturns. If you think you may benefit from a fixed index annuity, Feel free to give us a call, or send us an email.

0 Comments

Leave a Reply. |

Contact Us(208)297-7818 Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed